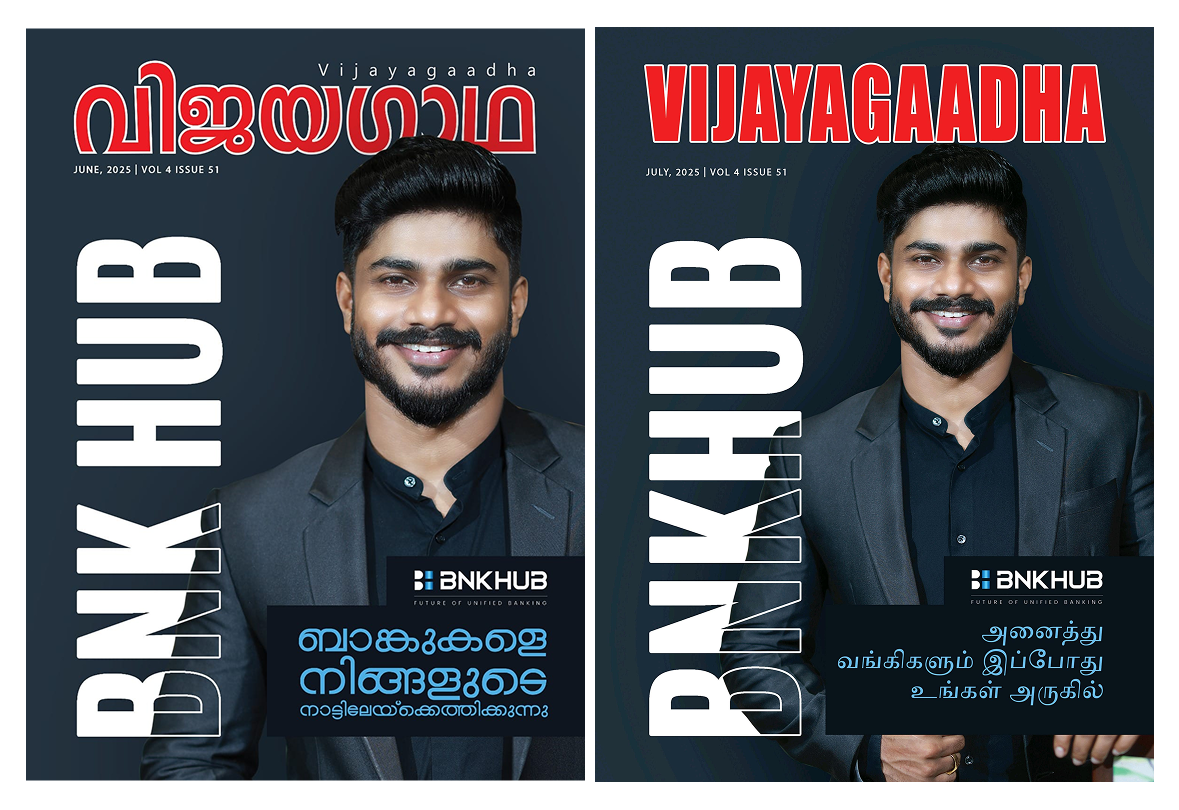

Future of Unified Banking Bnkhub

BNKHUB is a new-age fintech company revolutionizing access to banking and financial services across India through a phygital (physical + digital) model. We empower local entrepreneurs, shop owners, and service centers to become Banking Service Points (BSPs) — enabling people in rural and semi-urban areas to access essential financial services such as

Recharges,

Bill payments right at their doorstep through Bnkhub’s own Unified Banking concept.

Key Figures

5,700

+

Daily Customers Empowered

250

+

Trusted Banking & NBFC Partners

9,700

+

Merchant Hubs Nationwide

Franchise Enquiry

Join our growing network by exploring exciting franchise opportunities with us.

Click Herehighlights

BNKHUB brings banking and financial services to your shops.

With BNKHUB, customers no longer need to travel far or wait in bank queues — they can bank anytime, anywhere through their nearest BNKHUB outlet.

BNKHUB helps ordinary people become financial entrepreneurs by turning their shops or service centers into Banking Service Points (BSPs).

BNKHUB empowers entrepreneurs to grow with the fintech revolution — building business, income, and trust in their local communities.

More about us

Who We Are

BNKHUB Finserv Pvt. Ltd. is a next-generation fintech company building the bridge between traditional banking and digital innovation.Founded in 2024,

we are on a mission to make financial services accessible to every Indian, through a phygital (physical + digital) network of Banking Service Points (BSPs).

BNKHUB empowers local entrepreneurs and small businesses to deliver a full suite of banking

right in their communities —

creating opportunities, income, and financial inclusion across India.

MISSION

To revolutionize financial inclusion by building a nationwide Phygital network, seamlessly connecting unbanked individuals with essential banking services, ensuring equal access to the tools and services needed to achieve financial freedom and thrive together.

VISION

To create a financially inclusive India where every individual has access to secure, convenient, and empowering banking and financial services, regardless of location or background.

Scroll

Our Products

25+ Products

Unified BNKHUB platform for all financial needs—unifying banking,

Bill Payments,Recharges and digital payments under one ecosystem

Banking transactions

BBPS and Recharges

Bill Payments

Recharge

Featured Offerings

Manage digital transactions quickly and securely from one platform.

Why BNKHUB? ....................

Why BNKHUB?

01

Phygital Network

Local merchants act as financial touchpoints, powered by technology that tracks and manages services seamlessly.

02

Trusted Partnerships

We collaborate with regulated banks and NBFCs, ensuring all transactions are safe, reliable, and compliant.

03

Community Focused

Merchants earn extra income while helping their neighbourhood access essential services.

04

AI Innovation Driven

BNKHUB is integrating AI-powered agentic robots in retail outlets to assist customers with banking services—making financial access faster, smarter, and more human-like.A new era of intelligent banking begins, where technology and trust work side by side to serve every customer efficiently.

BNKHUB at Global Startup Summit 2025

The Future of Unified Banking, Driven by AI.

24/7 Reliability

High Uptime

Bank-Grade Security

Encrypted Data Protection

Intelligent Insights

Data Intelligence

Future-Proof Platform

Scalable Platform